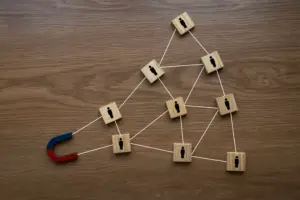

In the dynamic world of the financial and service industries, organization and excellent customer service are essential. This is exactly where a CRM system (Customer Relationship Management) comes into play. It not only helps streamline processes but also strengthens customer relationships and boosts efficiency. Whether you work independently or are part of a large corporation, choosing the right CRM system can revolutionize your business operations. In this article, we highlight the key benefits and features of CRM and share valuable tips on how to select the one that best suits your needs.

Why the Financial and Service Industries Need a CRM

Managing customer relationships in these sectors can be challenging. Every day, contract renewals, claims, multiple service providers, and regulatory requirements must be coordinated. Without a structured system, things can quickly become overwhelming.

- Better Customer Management: A CRM system centralizes all customer data, providing quick access to contract details, communication histories, and renewal schedules, making management significantly easier.

- Higher Productivity: Automated processes, such as sending reminders, updating contracts, or handling inquiries, save time. This allows professionals to focus on what really matters: sales and customer care.

- Improved Customer Experience: Personalization is the key to customer satisfaction. With a CRM, you can ensure tailored communication and timely service, which strengthens customer trust in the long term.

Key Benefits of CRM Solutions for the Financial and Service Industries

1. Centralized Customer Database

A CRM system consolidates all essential customer information, from contact details to contract data, on a single platform. This eliminates the need to manage scattered spreadsheets or paper files.

- Instant access to relevant data during client calls or meetings.

- Greater accuracy and fewer errors when processing contracts.

2. Optimized Workflow Automation

Automation tools within a CRM significantly simplify daily operations:

- Automatic reminders for contract renewals.

- Efficient tracking of claims and contract updates.

- Streamlined follow-up management for potential clients.

3. Improved Lead Management

Modern CRM systems offer advanced features for tracking and managing leads effectively. With lead scoring, professionals can focus on the most promising prospects, increasing conversion rates.

4. Personalized Customer Interactions

In a highly competitive market like Switzerland, personalized service is crucial. With a CRM, professionals can:

- Send tailored emails and offers.

- Track previous interactions to provide a customized customer experience.

- Schedule reminders for personal milestones such as birthdays or contract anniversaries.

5. Detailed Reports and Analytics

CRM tools provide valuable insights through comprehensive reporting and analytics:

- Monitor sales performance.

- Analyze customer retention rates.

- Identify trends to unlock cross-selling and upselling opportunities.

6. Compliance and Security Standards

In Switzerland, strict data protection regulations must be observed. A robust CRM system ensures compliance with GDPR and local laws while safeguarding sensitive customer information.

Key Features of a CRM System for the Financial and Service Industries

When selecting a CRM system, make sure it offers the following features, tailored to the specific needs of the industry:

1. Contract and Claims Management

A powerful CRM simplifies the management of the entire contract lifecycle and claims process:

- Secure document storage for contract records.

- Notifications for pending claims or expiring contracts.

- Integration with service providers for seamless updates.

2. Automation Tools

An effective CRM offers automation features such as:

- Email campaigns for marketing purposes.

- Task reminders for follow-ups.

- Automatic generation of quotes and proposals.

3. Customization Options

Since every business operates differently, the CRM should be customizable:

- Individually configurable dashboards to monitor key metrics.

- Data fields tailored to industry-specific workflows.

- Integration with existing tools, such as accounting software.

4. Mobile Accessibility

For professionals who are frequently on the go, a mobile-friendly CRM ensures uninterrupted access to customer data and task lists.

5. Multi-Channel Communication

A good CRM supports communication across multiple channels:

- Phone calls

- Messaging apps like WhatsApp

This ensures seamless customer interactions across all platforms.

6. Integration Capabilities

A CRM that connects with third-party tools, such as accounting software, email marketing platforms, or industry-specific databases, significantly increases its value.

7. Reporting and Analytics Tools

From monitoring sales performance to identifying market trends, advanced analytics help make informed decisions and maximize business opportunities.

How to Choose the Right CRM for the Financial and Service Industries

Selecting the best CRM system for your business can be challenging. This step-by-step guide makes the process much easier:

1. Define Your Needs

Start by analyzing your specific business requirements. Do you need better customer management, automation, or lead generation support? Clear priorities will help narrow down your options.

2. Check Industry-Relevant Features

Ensure the CRM includes features specific to your industry, such as contract management and claims tracking.

3. Evaluate User-Friendliness

A complicated system can hinder productivity. Choose a CRM with an intuitive, easy-to-understand interface.

4. Consider Scalability

Your business will grow, and your CRM should grow with it. Opt for a system that can handle increasing data volumes and user numbers.

5. Prioritize Data Security

Especially in Switzerland, data protection is of utmost importance. Make sure the CRM complies with GDPR and local regulations while offering robust security features.

6. Request a Demo

Most providers offer free demos or trial versions. Use these to test the features and check compatibility with your needs.

7. Compare Costs

Cost shouldn’t be your only deciding factor, but the CRM must fit your budget. Look for transparent pricing with no hidden fees.

Popular CRM Providers in Switzerland

Here are some of the most popular CRM systems frequently used by businesses in Switzerland:

- Salesforce CRM: Known for extensive customization options and powerful analytics.

- Zoho CRM: A budget-friendly solution with a wide range of features.

- HubSpot CRM: A free option with essential tools—ideal for small businesses.

- Insly: Designed specifically for industry professionals.

- AgencyBloc: Optimized for statutory health insurance providers.

Conclusion

Investing in the right CRM is more than just a business decision. It’s a strategic move to strengthen customer relationships, increase efficiency, and remain competitive in a challenging market like Switzerland. With the right features, benefits, and provider, a CRM can transform your business processes and secure long-term success.

FAQs

1. What is a CRM for the financial and service industries?

A CRM is a specialized tool that helps businesses manage customer relationships, streamline workflows, and enhance customer service through a centralized platform.

2. How does a CRM improve customer retention?

A CRM boosts customer loyalty through personalized communication, timely reminders for contract renewals, and efficient handling of inquiries, ensuring that clients receive exceptional service.

3. Can small businesses benefit from a CRM?

Absolutely. CRMs such as HubSpot and Zoho offer affordable plans tailored to small businesses, helping streamline operations without straining the budget.

4. Is a CRM in Switzerland secure enough for customer data?

Yes. Most CRM systems comply with GDPR and local data protection laws, offering advanced security features to safeguard sensitive information.

5. How much does a CRM cost?

Prices vary depending on the provider and range of features. Basic plans start at around USD 10 per month, while more comprehensive systems can cost over USD 100 per month.